As defined by Investopedia, Days inventory outstanding (DIO), also known as Days Sales of Inventory (DSI) and Days in Inventory (DII), is a financial ratio used to measure the average number of days that a company takes to turn Inventory into sales.

Generally, a low figure indicates that the time in which cash is tied up in stock is short and that there is a lower risk that Inventory will become out of date.

What is the Days Inventory Outstanding (DIO) formula?

It measures the company’s average time to turn Inventory to cash, is a financial ratio used as a liquidity metric to estimate a company’s financial and operational efficiency.

To calculate the Days of Inventory Outstanding, you can use the following formula:

DIO = average inventory/cost of goods sold x number of days in a period

Where:

- DIO = Days Inventory Outstanding

- Average Inventory = (Inventory at the beginning of the period + Inventory at the end of the period) / 2

Sometimes companies also take the value of Inventory at the end of a reporting period to calculate the Days Inventory Outstanding.

- Cost of goods sold (COGS) is the cost of producing goods sold during the period. It includes the cost of raw materials, labor, and production overheads such as utilities.

- The number of days represents the duration of a reporting period in days. For example, it can be 365 days for a year or 90 days for a quarter.

Days Inventory Outstanding example

Let’s assume that Company XYZ has an average inventory of $50,000 for the period ended in 2020 and the cost of goods sold was $200,000. So, what would be the Days Inventory Outstanding of Company XYZ?

First, let’s take the formula and input the figures given.

Days Inventory Outstanding (DIO) = Average Inventory / Cost of Goods Sold * Number of days in a period

Since the period refers to the whole year of 2020, the number of days equals 365.

Days Inventory Outstanding (DIO) = $50,000 / $200,000 * 365 = 91.25 days

So, this means that it takes 91.25 days for Company XYZ to sell its Inventory and generate cash.

What does a high or low Days Inventory Outstanding (DIO) indicate?

Depending on the industry, a typical DIO can considerably vary. So, to analyze and draw conclusions on a company’s performance, you should compare its Days Inventory Outstanding ratio with that of other companies in the same sector. Let’s see what high and low Days Inventory Outstanding mean.

High Days Inventory Outstanding (DIO)

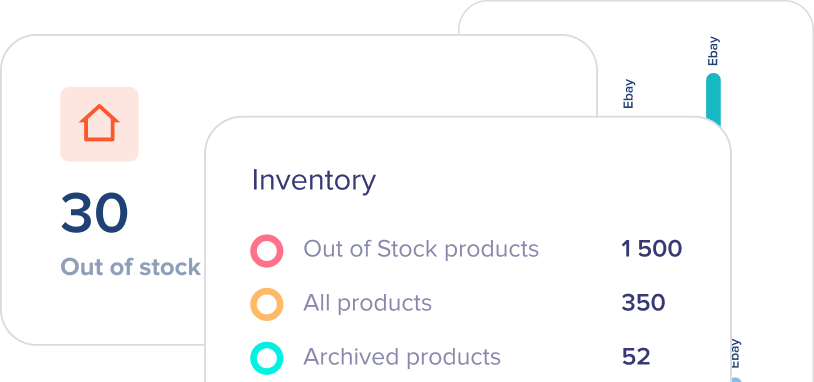

When a company has a high Days Inventory Outstanding ratio, it indicates that it is not quickly converting its stock into sales. So, the cash is tied up to the Inventory for a long time and cannot be used to finance other activities or make profitable investments. A high DIO ratio is also a possible indicator of overstocking, which in its turn can lead to unnecessarily high storage and warehousing costs as well as the high risk of stock being obsolete. All these overall means that the company lacks effective inventory management compared to its competitors within the same sector.

Low Days Inventory Outstanding (DIO)

When a company shows a low DIO ratio, it might indicate that it is rapidly converting its Inventory to sales. So, the working capital, such as cash, is for other business operations or for paying down debt. For a company with a low DIO ratio, the risk of getting obsolete stock and unavoidable write-offs reduces too. However, a low DIO is not always absolutely good. It might also mean that the company is struggling to meet a sudden increase in market demand.

Despite comparing a company’s performance to others in the same sectors, one can draw conclusions by looking at a particular company’s DIO performance trends over time. For instance, a decrease in the DIO ratio may indicate that the company improved its inventory management practices and is selling Inventory faster than in the past. On the other hand, a higher DIO over time suggests that the sales have slowed down.

How to improve Days Inventory Outstanding?

Generally speaking, a lower DIO ratio is more favorable than a higher one. So, the company’s goal should be to reduce DIO by speeding up the conversion of Inventory into sales while being able to meet market demands.

There are some strategies that companies can integrate in order to decrease their DIO. Some of them include the following:

Improved forecasting: Companies should aim to make accurate inventory forecasts and plans to avoid discrepancies between predicted and actual sales. With valid sales and demand forecasts, there will not be a need to keep higher than necessary volumes of stock.

Learn more about inventory forecasting.

Improved marketing campaigns: Companies can increase demands and sales by integrating more effective marketing strategies. The more are the sales, the faster inventory moves and generates cash. Thus, the DIO will improve.

Optimizing inventory levels: Businesses should aim to find the optimal inventory levels to reduce Inventory holding periods as costs are associated. So, there are no extra inventory volumes in storage under the risk of getting obsolete. For example, one of the techniques that you can use is just-in-time delivery, when a company receives stock as close as possible to when they are actually necessary.

To sum up

There are no absolute favorable standards of optimal DIO ratio. However, having it lower is generally more desirable for a company. By the implementation of proper inventory management practices DIO metric can also improve.