To ensure long-term success for your business, it is essential to set the right selling price for your product.

Underpricing your products and services can cause significant financial and resource damages and drastically affect your brand reputation.

Overpricing, on the other hand, can leave you out of the competitive market.

Therefore it is essential to find the perfect balance. This means you should establish a pricing point that will help you maintain your market position. What’s more, you should have a competitive edge, satisfy the demands of your customers, and allow your company to grow and prosper.

How to calculate the selling price of a product?

The selling price of a product or a service is essentially the price that the buyer is willing to pay.

The selling price is critical in determining how much revenue a company must make to meet a profit margin target. Additionally, while determining reasonable selling prices, firms and organizations often consider a variety of issues. They may pose several questions for that. For example, how much consumers are willing to pay and, of course, how much the seller is ready to take.

Moreover, businesses have to ensure that the price they set for their services and products remains competitive compared to other companies in the market.

Keep in mind that depending on the sort of operations and objectives, the ways firms and organizations employ to examine problems like these and compute selling prices might differ. Nonetheless, there is an easy method for calculating the average selling price:

Cost + Desired profit margin = Selling price

In the formula mentioned above, the cost indicates the cost of goods sold (the costs you pay to create or acquire things to sell), the desired profit margin is the profit margin you want to generate.

This basic formula will help you have a fundamental understanding of where to start with your product price. Consider that you can also use the results of your selling price in combination with other factors. This will help you define competing prices and the most appropriate selling price for your item.

How to estimate the average selling price?

The average selling price is the price at which a product in a particular category is sold in various marketplaces and channels. To calculate ASP, use the following formula.

Average selling price = Total revenue received from the product ÷ The number of products sold.

Keep in mind that regardless of whether you sell an item with 15 or 150 stock-keeping unit variations, you determine the selling price by dividing all revenue collected from those sales by the total number of units sold.

What is the sell-through rate?

Self-through rate is the connection between the amount of inventory you sell and the amount you buy from your supplier or manufacturer in a particular time frame.

To put it into other words, it quantifies the time it takes for inventory to turn into income. Self-through rate is a prevalent measurement method among retailers and is also vital for companies that deal with inventory management.

It is essential to take into account that the sell-through rate can have long-term consequences for your company’s costs, cash flow, turnover, to name a few.

Keep in mind that the more comprehensive, insightful understanding you have of your sell-through rate, the better equipped you’ll be to see products that aren’t performing well in the market.

Once you identify the products that are not selling well, you can organize discounts and upsell. This will help you manage profit while minimizing financial loss. Remember that ignoring your sell-through rate can cost additional, undesirable expenses such as storage and warehousing costs. Moreover, you may also risk having low customer conversion rates. This can be pretty damaging to the overall success of your business.

How to calculate the sell-through rate?

Monitoring your sell-through rate can give you more control over your inventory and help you to make more informed decisions.

To compute your sell-through rate, you may start keeping track of the total number of units sold. You can also track existing inventory for the month or quarter. Next, you will need to divide the total number of units sold by your inventory at the start of the quarter to get your sell-through rate.

To convert this amount to a percentage, you will need to multiply it by 100.

The greater the proportion, the less product you will end up having on the shelf or in your warehouse. Once you know which data sources and inventory management systems to utilize, tracking your sell-through rate will be much easier.

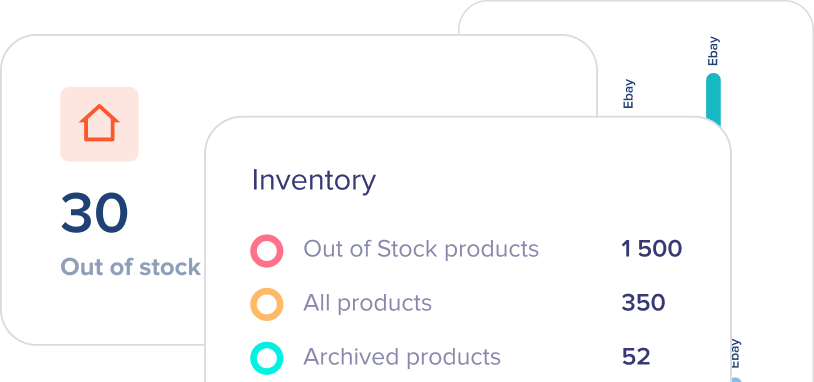

With modern inventory management systems in place, you will be provided with quick and straightforward access to all of the peculiarities regarding your inventory. One of such inventory management software eSwap will provide you with sales reports segmented by sales channel, product brands, clients, price list categories, order status, and more.

Moreover, with eSwap, you will view gross and net sales, profit margin, etc. You can see the value of your inventory at each location. Also, you can check the amount of stock you have, receipts, inventory movements between warehouses, In short, you can have any information to help you understand, value, and manage your business.