Ending inventory refers to the monetary worth of a product that is still available for purchase at the end of an accounting period.

It is an essential component for calculating the Cost of goods sold (COGS) and the inventory balance at the end of the year. Ending inventory should be in the balance sheet, which is crucial when presenting financial data to get funding. Smaller businesses can occasionally determine their ending inventory by counting the merchandise left over at the end of a fiscal month. On the other hand, most companies utilize a formula to calculate the overall worth of the product that is left over.

As part of a debt covenant, financial institutions often require that specified financial ratios such as debt-to-assets or debt-to-earnings be maintained by the date of audited financials. Investors and creditors regularly watch audited financial accounts in inventory-heavy firms like retail and manufacturing. In addition to calculating ending inventory under typical business conditions, you might need to write down the inventory for various reasons such as fraud, market value declines, to name a few. Once the customer demand for the product decreases, the market value of the inventory may fall too.

Why is ending inventory essential?

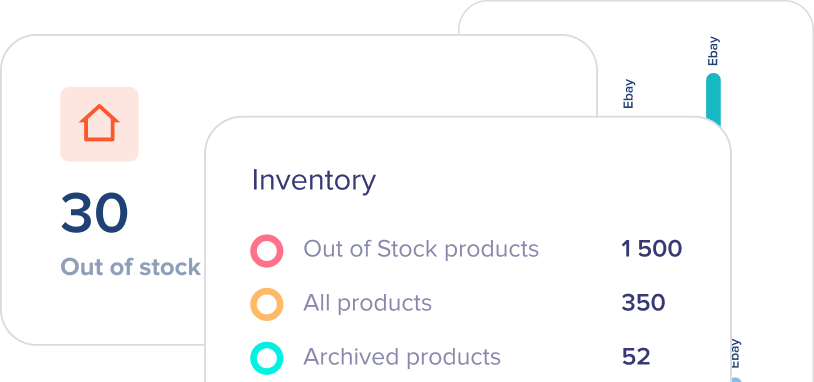

Being aware of your ending inventory will ensure that the inventory you’ve recorded corresponds to the actual stock you have on hand. If your inventory level is lower than expected, you may risk your overall business and have inventory loss.

Estimating the ending inventory will help you determine the net profit of your business. Eventually, you’ll want to know the precise income statement or how much money you’re generating from your company. When you apply the ending inventory formula, you will also understand whether your actual stock matches the inventory you’ve recorded. Once you see the bigger picture and know that the numbers do not add up, it might mean you paid too much for the items in the first place, based on current market worth. It may also be a sign that you need to modify your pricing approach.

What is the ending inventory formula?

To calculate the ending inventory, you can use the following formula:

Ending inventory = Beginning inventory + Net purchases – COGS

The beginning inventory in the formula stands for the monetary quantity of product the firm possesses at the start of the accounting.

The net purchases predispose the Cost of any new product or inventory items purchased during the accounting period.

Finally, the Cost of goods sold refers to producing items that are part of the company’s inventory.

What are the methods of estimating ending inventory?

Various methods can help you calculate your ending inventory, and each can differently impact your financial results. Therefore it is essential to choose a way that fits your business best.

FIFO

One of the ways to calculate your ending inventory is the FIFO method (first in, first out). FIFO is an accounting system that implies the most recent inventory acquired is selling first. This strategy adds the Cost of your most recent inventory purchases to your COGS before adding the Cost of your previous purchases to your ending inventory.

This approach of estimating ending inventory is based on the assumption that businesses should sell their oldest things first to retain the newest items in store. It is essential to mention that the FIFO approach will result in a greater final inventory quantity during inflationary periods.

LIFO

Another method of calculating ending inventory is LIFO (last in, first out). LIFO approach predisposes that the most recently purchased inventory items are sold and shipped out first. When a corporation uses the last-in, first-out technique, it decides its ending inventory by looking at the Cost of the most recent item acquired. This method presupposes that the value of the most recently purchased product is the same as that of the first product sold. It also assumes that the company sells the most recent product first. The LIFO method prioritizes most recent purchases and classifies earlier purchases as ending stock for the value of goods sold.

Weighted Average Cost

Last but not least, you may use the method of the weighted average cost. The ending inventory and COGS are valued using the weighted-average cost technique. It divides the total cost of items produced or acquired in an accounting period by the total number of products created or bought. The weighted-average cost technique, unlike the abovementioned techniques, allocates the same value to each item purchased. The weighted average can be an efficient method to balance the LIFO and FIFO systems.

What is the beginning inventory?

Beginning inventory is the monetary worth of all inventory held by a company at the start of an accounting period. It reflects all the products that can generate income. Applying the beginning inventory formula at the start of a new accounting period will help you better comprehend the worth of your inventory. It is vital to remember that beginning stocks must match ending stocks from the prior accounting period.

How to calculate beginning inventory?

You may calculate your beginning inventory with the following formula.

Cost of goods sold + Ending inventory – Purchases

First, you need to use the data from the preceding accounting period and calculate the Cost of goods sold (COGS). Up next, you will need to multiply your ending inventory balance by the Cost of producing each item, then repeat with the quantity of new inventory. Estimate the inventory at the end of the day and the cost of products sold. Finally, you will need to deduct the quantity of stuff you bought from your total to obtain your beginning inventory.

Why is beginning inventory valuable?

Beginning inventory is a valuable method for better understanding a company’s sales and operational patterns and modifying the business model based on the data. Beginning inventory is primarily used as the starting point for calculating the cost of products sold for an accounting period.

You can calculate COGS in the following way.

Inventory at the start of the period + Purchases made during the period – inventory at the end of the period = Cost of goods sold

Beginning inventory can also be used for internal accounting and other related documents. Beginning inventory will provide you with valuable insights into how much your stock is worth. This is helpful for internal accounting records like income statements. It can also enable you to determine whether there are any irregularities or inventory loss. Beginning inventory will allow you to conduct inventory modifications. You can monitor inventory’s value in the market and whether you can sell it. It will also help you ensure that you order a precise amount of products and avoid overstocking or understocking.

Depending on particular cases, beginning inventory can also be beneficial for tax considerations. Some transactions and types of items may be tax-deductible. Therefore, reserving an additional amount of inventory is essential to meet your customers’ needs swiftly. Keep in mind that this does not apply to all types of tax cases. Hence it is necessary to conduct additional research or consult with a tax specialist.