What is inventory?

Inventory is an essential component of every growing business. It includes the raw materials, the work-in-process goods, and the finished goods. As all of these assets are convertible into cash within one year or less, inventory is a current asset.

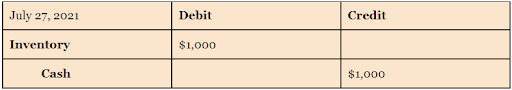

In accounting, assets increase with a debit, which means that when recording a journal entry in case of purchasing new inventory, you debit the inventory account; otherwise, you credit it. Most of the time, the accounts credited when debiting inventory would be either cash or accounts payable. This is because to purchase new inventory, a certain amount of cash should be either paid or billed on account.

What is a perpetual inventory system?

There are two main types of inventory management systems: perpetual inventory system and periodic inventory system.

A perpetual inventory system is an inventory management method to record the transactions of goods at the time these transactions take place. In perpetual inventory management, the inventory is consistently updated with a sale or purchase of every good. With perpetual inventory management, you should organize your data in a way that will make it easy for you to access your desired information momentarily.

How to calculate inventory in a perpetual inventory system?

Since the inventory amount keeps changing with every new sale or purchase, the companies need to keep track of their inventory. Thus, there are four ways to calculate inventory in the perpetual system. i

- FIFO (first-in-first-out)

- LIFO (last-in-first-out)

- Specific identification

- Weighted average

FIFO (first-in, first-out)

FIFO measures the changes in inventory with the following principle: it considers the goods sold first to be the ones that were purchased first.

Let’s take a look at the small inventory problem below to understand the steps required to calculate the ending inventory by using FIFO.

Example

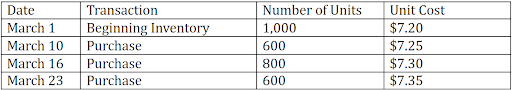

The following information refers to the inventory of the XYZ store. Given that the XYZ store has sold 2,300 units of inventory during the month, calculate the cost of goods assuming FIFO.

First, we are given that the total inventory owned by the XYZ store before the sale was equivalent to 3,000 units. This includes the sum of beginning inventory and all the 3 purchases made during the month (1,000 + 600 + 800 + 600 = 3,000).

However, note that it is mentioned in our problem that the XYZ store has sold only 2,300 units of inventory. Now, we should determine the COGS by using FIFO.

As you read above, when implementing FIFO, we consider the company to first sell the inventory, which it has purchased earlier. Thus, for calculating the COGS for the sold 2,300 units of inventory, we would take the first 1,000 units of beginning inventory, then add the next 600 units from the purchase of March 10.

We will have only 700 units left since we have already added 1,600 units of inventory, and the total number of sold inventory is 2,300 units. We will, afterward, add these 700 units from the purchase of March 16. As a result, we will have 700 units left as our ending inventory (2,300 – 1,600 = 700).

To calculate the COGS with FIFO, multiply the number of inventory units sold by the price those units have been purchased with. In our example, it would be

COGS = 1,000 x $7.20 + 600 x $7.25 + 700 x $7.30 = $16,660

FIFO is mostly for those types of goods that are more likely to spoil with time. Those include fresh food, fruits, and vegetables, etc. For products like this, companies first sell the units that they had purchased earlier. Therefore, food markets, fruit and vegetable stores, and companies like these are more likely to be keeping track of their inventory through FIFO.

LIFO (last-in, first-out)

LIFO assumes selling those units of inventory the first that the company has purchased the last. The calculation of COGS under LIFO is similar to the one of FIFO with a difference that for calculating the sold goods, we are starting from the company’s latest purchase. For our sample problem, we would calculate the COGS under LIFO by starting from the purchase of March 23. As a result, we will have

COGS = 600*7.35 + 800*7.3 + 600*7.25 + 300+7.2 = 16.760

Weighted Average Cost

The weighted average cost method is the most common one for calculating the COGS of similar or identical products. Since they are similar, their prices are also close or even the same. This is the reason why you use the average price to measure the overall COGS.

Here is how you come up with a weighted average cost (WAC) based on our example.

We calculate the COGS for all the purchased units, which will give us:

1,000 x $7.20 + 600 x $7.25 + 800 x $7.30 + 600 x $7.35 = $21,800

Next, we divide this number by the number of all units available for sale (1,000 + 600 + 800 + 600 = 3,000).

This gives us $21,800 / 3,000 = $7.27

Thus, our weighted average price for 1 unit of inventory is $7.27. Given that the IXYO store has sold 2,300 units, we multiply 7.27 by 2,300 to find the COGS for all the 2,300 units. This gives us $16,721.

Specific identification

Lastly, specific identification is used when companies choose to track every single unit of inventory separately. Thus, they manage all the calculations with the same price they have purchased the goods. This is the most accurate yet the most time-consuming type of calculating COGS in a perpetual inventory system.

Perpetual VS Periodic inventory

Another type of inventory valuation is a periodic inventory system. Under this system, the company does not consistently track their COGS; instead, they count the COGS on a physical basis. The formula for this is the following:

COGS = Beginning inventory + Purchase – Ending Inventory

Beginning inventory is the inventory the business has at the start of the fiscal year. It may also be that the beginning inventory equals 0 when the company is new, and there is no inventory yet. Ending inventory is the inventory which remains after purchasing and selling any proportion of inventory.

Perpetual inventory is more preferable if the business is big, and counting COGS physically would take substantial time and effort. In contrast, a periodic inventory system might be giving you more accurate calculation results.

Final thoughts

Whichever method of inventory management system you end up implementing, you will have to record journal entries for the inventory-related transactions.

If selling an inventory, debit Cash or Accounts Receivable and credit Sales for the amount you have sold your inventory.

If buying an inventory, debit Cost of Goods Sold and credit Inventory.