What is the order to cash (O2C) process?

The order to cash process is the complete order processing cycle run by a business or a company. The process begins from the very moment the customer places an order. It ends with the data reporting and analysis conducted by the company.

The order to cash process plays a crucial role in the healthy development of the company. It has a massive impact on the company’s inventory management, supply chain management, and workforce management.

The diligent performance of the O2C cycle ensures effective distribution of goods and services by enhancing the inventory management. It contributes to the improvement of a customer experience by pushing the business forward in the marketplace. Also, O2C strengthens its supply chain management. Furthermore, by automating the O2C cycle accordingly, you will be able to manage your labor efficiently by assigning a reasonable number of tasks to an automated mechanism instead of assigning them to the workers.

What are the steps of the order to cash process?

The order to cash process consists of 8 steps. Each of them requires a specific approach and has a connection with the proceeding processes with a well-planned algorithm. Hence, failure to manage one of the steps accordingly will affect the entire cycle adversely. The 8 steps include:

- Order management

- Credit management

- Order fulfillment

- Order shipping and transportation

- Customer invoicing

- Accounts receivable

- Payment collection

- Reporting and data management

Let’s now go through all of them separately to understand better how the entire process works.

Order management

Order management is the first step of the O2C cycle. As soon as the customer places the order, the order management starts taking place. The order placement can be done online, through an e-commerce website, in the store, or through a social media page of the company. Whichever of the mentioned options your customer has chosen to place their order, you should take care of managing it appropriately. It is recommended for your order messages to be automated so that once the order is placed, all the departments of the company start functioning accordingly and process the order on time. To make this process take place as smoothly as possible, it is desirable to minimize the number of platforms you are using to control your orders. eSwap offers multi-channel order management from one platform.

Credit management

The credit management stage is particularly important for new customers. If it is their first time placing an order to your company, you should make sure they are provided with the credit they need, in case they are eligible for it. If they have placed orders previously, and already have a credit account on your platform, the order management message should automatically guide them through the order fulfillment stage.

Order fulfillment

This is the phase where you start physically processing your customer’s order. We have mentioned earlier in this article that the O2C process has tight connections with effective inventory management implementation. It is in the stage of order fulfillment when you need to have a well-organized inventory management system available.

The companies will benefit if they adopt the perpetual inventory management system. It would require them to update the inventory counts constantly. Systems like eSwap enable updating your inventory number automatically after every sale and purchase.

In this case, you will avoid issues like running out of inventory when your customer places an order. Thus, you will be able to fulfill the order fast and efficiently. As a result, you will save effort and will provide advanced customer service.

Order shipping and transportation

Like the other stages, the shipping stage also depends on the phases that were conducted prior to it. Shipping is the stage for which you should consider the biggest amount of caution and responsibility. You should make sure to keep your shopping team informed about the order fulfillment process. You can do so by sending them automated messages containing the product delivery information, the location, the receiver data, etc.

Shipping is the component of the O2C cycle that will put a start to your company’s in-person relationship with your customer. Thus, make sure to organize it as diligently as possible.

Customer invoicing

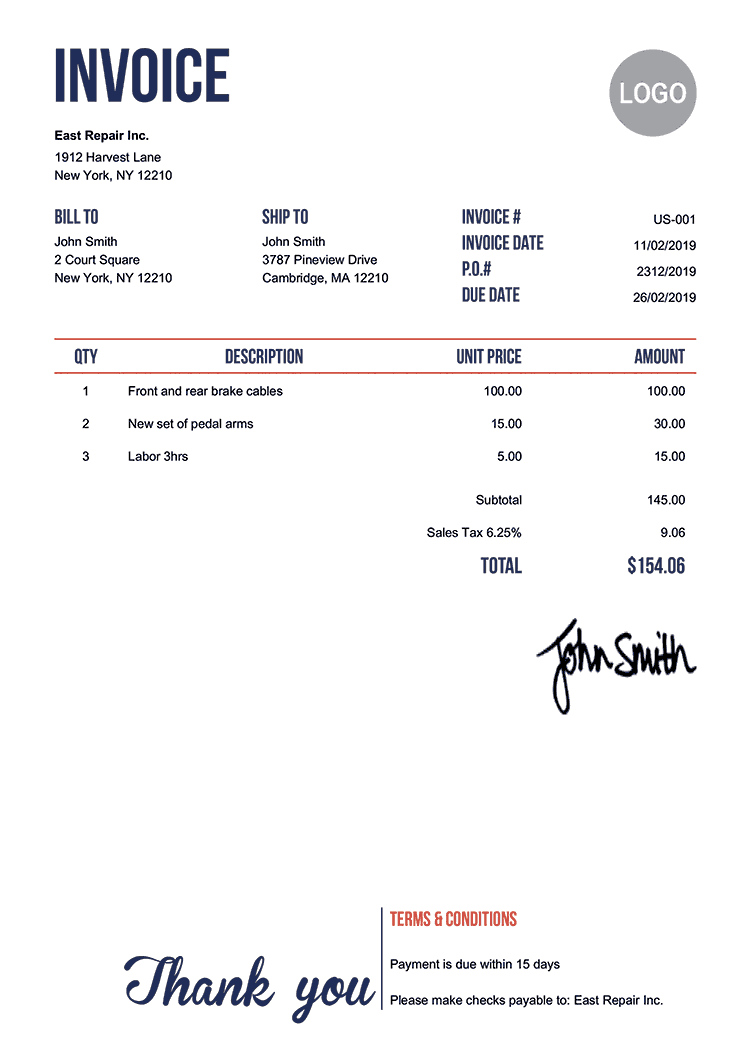

Processing accurate and neat invoices is essential to guarantee a seamless purchase for your customers and verified sales for you as a company owner.

If this is your customer’s first time placing an order to your company and they have gone through the credit management stage already, you should debit your accounts receivable once the customer places the order. After your team ships the order, you should send the invoice of the purchase to your customer with the mentioned date due which their payment is. Failing to conduct this process might result in inaccuracies in your sale amounts and will leave you with no proof of having successfully fulfilled and shipped the order.

Below, please, see an example of an invoice you should prepare for every order your customers place.

Source: invoicehome.com

Accounts receivable

The team of accounts receivable is responsible for keeping track of the invoices the company sends to its customers after shipping the order. They should make sure to hand all the invoices to the customers on time, otherwise, examine the reasons for probable delays. In case of any delays, they should send out new invoices and make sure the customers are aware of the payments they need to make.

Payment collection

Payment collection is the stage where the customers should pay for the order. Meantime, the company should receive them due to the date they had mentioned in the invoice.

In order for the company to keep track of the customer payments, it should set up an automated mechanism that would notify the team of accountants about the payment made by the customer.

The company should avoid asking for a payment to the customers that have already paid for their purchase. Otherwise, this would result in mistrust and suspicion for the clients towards the company.

If there are any delays found out in the payment collection stage the company should come up with strategies to receive the payments. Those may include sending out reminders to the customer, setting limitations for further purchases, putting restrictions on a customer’s user account, etc.

Reporting and Data Management

This is the final stage of the order to cash process that the company undertakes. This involves an evaluation of all the flow of the O2C process, the examination of recorded errors and failures, and the analysis of strengths and weaknesses the company has demonstrated.

All the issues found out during the entire process are discussed and monitored during this stage. The customer behavior and attitude are closely reviewed, and conclusions are drawn as a result.

Ultimately, the company gets to improve its service by making its processes more seamless, fast, and efficient.