Pricing is a strategic issue for any business operating in a modern competitive market. Setting the right price is one of the major issues that each company has to solve. Knowing how to deal with the wholesale price calculator will significantly help those companies.

Before moving to the part of wholesale price calculations, let’s start with the basic understanding of the wholesale price.

What is the wholesale price?

Wholesale price refers to the prices set for products for wholesale sales. Generally, a manufacturer sells large quantities of goods to retailers and distributors in the wholesale sale stage. Because of the large volumes involved, the wholesale price is set at the lowest rates to enable other supply chain stakeholders to generate profit margins. So, the manufacturers receive their benefits from the large quantities, not from the high prices.

The goal should be to set a wholesale price at a level that ensures tidy profits. Meanwhile it should not be unreasonably high. To maintain within that range of reasonableness, manufacturers should consider external factors such as market prices, demand patterns, competitor strategies, etc.

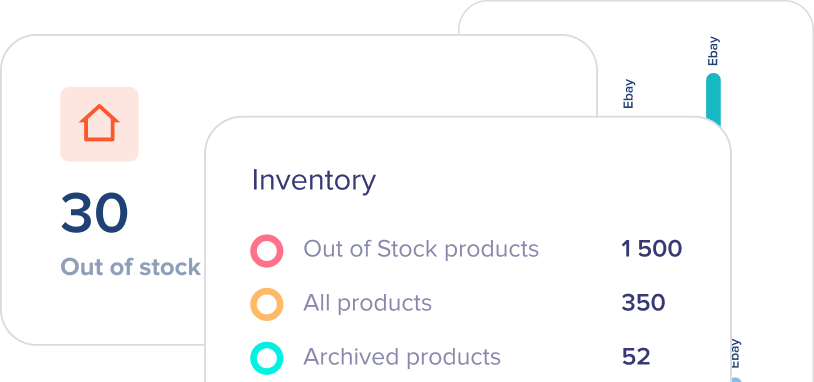

You can use an online technical calculator to determine the wholesale target price for your products.

Wholesale pricing methods

Depending on business selling goals and market research, different businesses may choose different pricing strategies to set the wholesale price. Let’s discuss some of the wholesale price calculator methods below.

Absorption pricing

Absorption pricing represents a cost-based pricing model. Also referred to as cost-based or cost-plus pricing, it indicates that you should first determine all the manufacturing costs before setting the prices. Then, by adding make-up at the top, you can select the wholesale price for the product.

Learn how to calculate manufacturing overhead costs here.

The most significant advantage of the absorption pricing model is its simplicity. Additionally, with well-tracked ongoing costs, your business can ensure consistency in returns.

On the other hand, when the manufacturing costs are high, businesses should adjust the price. The weak side of this approach is that it ignores external conditions. Those include the strategies of other players and the market demands.

Differentiated pricing

We can compare the differentiated pricing model with the auction pricing in a way that both depend on demand. Under this strategy, prices are flexible rather than fixed, which means they can change depending on the situation.

For example, in cases of low competition, the prices are higher than average market rates. On the other hand, if the business has a goal to sell large product volumes quickly, then it should set prices lower than the market averages.

So, the overall idea of differentiated pricing is to adopt strategies to suit the goals and changing circumstances. The challenge here is that the business should have strong agility and be ready for quick changes.

Value-based pricing

Under the value-based pricing model, businesses aim to determine how much the customers are willing to pay for their products. It usually assumes high pricing, which is used for luxury and high-end brands. When customers categorize your product under the luxury label, they assume that the product is of high worth, so you may set a premium price.

Although a value-based pricing model usually ensures a high profit margin, the disadvantage of high prices is that the customer segment is generally small.

Market-based pricing

The market-based pricing strategy assumes that businesses use competitor’s prices as a standard. If a company follows this approach, the prices should be set on the same level as competitors or lower to attract more buyers.

You can generate good profits by implementing effective cost management strategies that ensure low costs and thus lower market prices. However, this can be a highly challenging task for businesses just starting or are small.

Bundle pricing

Under the bundle pricing model, businesses sell two or more products at a single price, which is slightly less than the sum of their separate prices. Even a slight reduction affects people psychologically by making them feel that they are getting products at a more reasonable price.

The challenge for businesses using this approach is to ensure that adequate sales volumes are generated so as not to end up as a loss-maker.

Challenges when determining the wholesale price

Many companies believe that setting the right wholesale price is one of the most complicated tasks of the selling process because of all the effort to calculate and make decisions. It might be a fair concern because there are truly many challenges that businesses deal with when choosing the right pricing strategy and setting the wholesale price. Some of the most common challenges are the following:

- Brand positioning and identity: One of the critical factors in how customers perceive your brand and value products is the pricing. The challenge here is to find the right price that represents the value of your product and yet meets the buyers’ expectations.

- Competition: Nowadays, almost any market is highly competitive. It means that to generate sales, businesses should set prices following market trends or even lower. The challenge with the latter is that it might cause a price war, reducing market prices to even lower levels.

- Seasonality: Customer needs can change seasonally. As a result, product categories are seasonal in character, which means that their demand patterns fluctuate. High market demand periods are followed by the lower ones creating stressful pricing challenges for businesses.

To sum up

The general truth, regardless of the model you choose, is that the best wholesale pricing strategy should be customer-oriented yet not affect the instant profits of the overall market. Of course, all that should also consider your business needs. You don’t want to end up in a loss-making position.