All the businesses starting from small to large experience the difficulty of estimating the monetary value of the total inventory they owe. It is important to keep the recording data accurate to have a disciplined and healthy inventory management system.

There exist different accounting principles for keeping track of the goods sold and goods in stock. One of the well-known principles is the average cost, and the corresponding method is called moving average inventory valuation method.

Moving Average Unit Cost (MAUC): Definition

First things first, what is Moving Average Cost, why is the calculation of Moving Average Unit Cost important?

MAUC or simply moving average cost is an accounting term, inventory valuation method applicable for calculating the average unit cost of each sold good or item in stock after receiving new purchase orders.

The calculation is as follows: Add the cost of the newly purchased item to the cost of the previously existing item in the inventory and divide the sum by the current total number of goods.

Moving Average Unit Cost: Calculation Methods

There are 3 main methods for calculation of the Moving Average Unit Cost.

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Linear Weighted Moving Average (LWMA)

Simple Moving Average (SMA)

![]()

where,

- n = Number of Data

- d = Moving Average

- Days M = Data

SMA or arithmetical moving average is a simple method helping to calculate Moving averages. As the name itself says, the method is identifying the average of the selected prices. This simple method helps to identify the closing price of a security for several time periods, and the result is being divided by that same number of periods.

Exponential Moving Average (EMA)

The EMA or exponential moving average is another type of moving average used to give more importance to the recent data points. Due to the help of exponential moving average or exponentially weighted moving average you can calculate the recent price changes on the contrary to simple moving average (SMA) which is applicable for calculating the equal weight to all observations in the period.

Linear Weighted Moving Average (LWMA)

Linear Weighted Moving Average (LWMA) refers to the data calculation, which is considerably more valuable than the earlier data. The calculation of the LWMA is about multiplying your closing prices by a weight coefficient.

Calculation of Moving Average Unit Cost as an inventory valuation method is never simple. However, the pain is worth the gain. With the help of this tool as an Inventory Valuation Method, your products will always be sold at the most relevant prices, ensuring your current price is the best to serve the demands of your Clients and your Business needs.

Benefits of Calculation of Moving Average Unit Cost

Due to the constant updating process of your inventory costs as soon as the new goods are accepted, Moving Average Unit Cost Calculation allows you to have the most recent value of your goods sold. This is an important tool if you’re trying to make predictions over the future of your inventory.

The Calculation of Moving Average Unit Costs is vital as it will help you to have a diagram to see how the moving average value changes over the months and forecast how the costs would look like in the future.

- This method helps the businesses to sell goods in stock without focusing on the purchase order tags and spending time on it. Each time the new incoming stock is tracked, costs are evaluated based on the current moving average cost data.

- This method is valuable as it helps to evaluate the value of inventory more accurately other than the other formulae for Inventory Cost Calculation. This technique is useful for your understanding of not undervaluing the costs of your goods on sale and having a problem with taxation as well. There is the case of the opposite as well-Overvaluing your stock. The probability of overvaluing your stock is reduced with the help of this technique.

- The businesses which use a perpetual inventory system for tracking their inventory will find this method extremely valuable as it gives reliable data for the calculation of the costs of the goods sold.

- The companies which need to calculate the average stock costs at the warehouse level rather than on the company level will find this method extremely applicable as they may have a large amount of inventory at different regions and the data will be difficult to track. This problem partly occurs as the price tags at different regions vary sometimes.

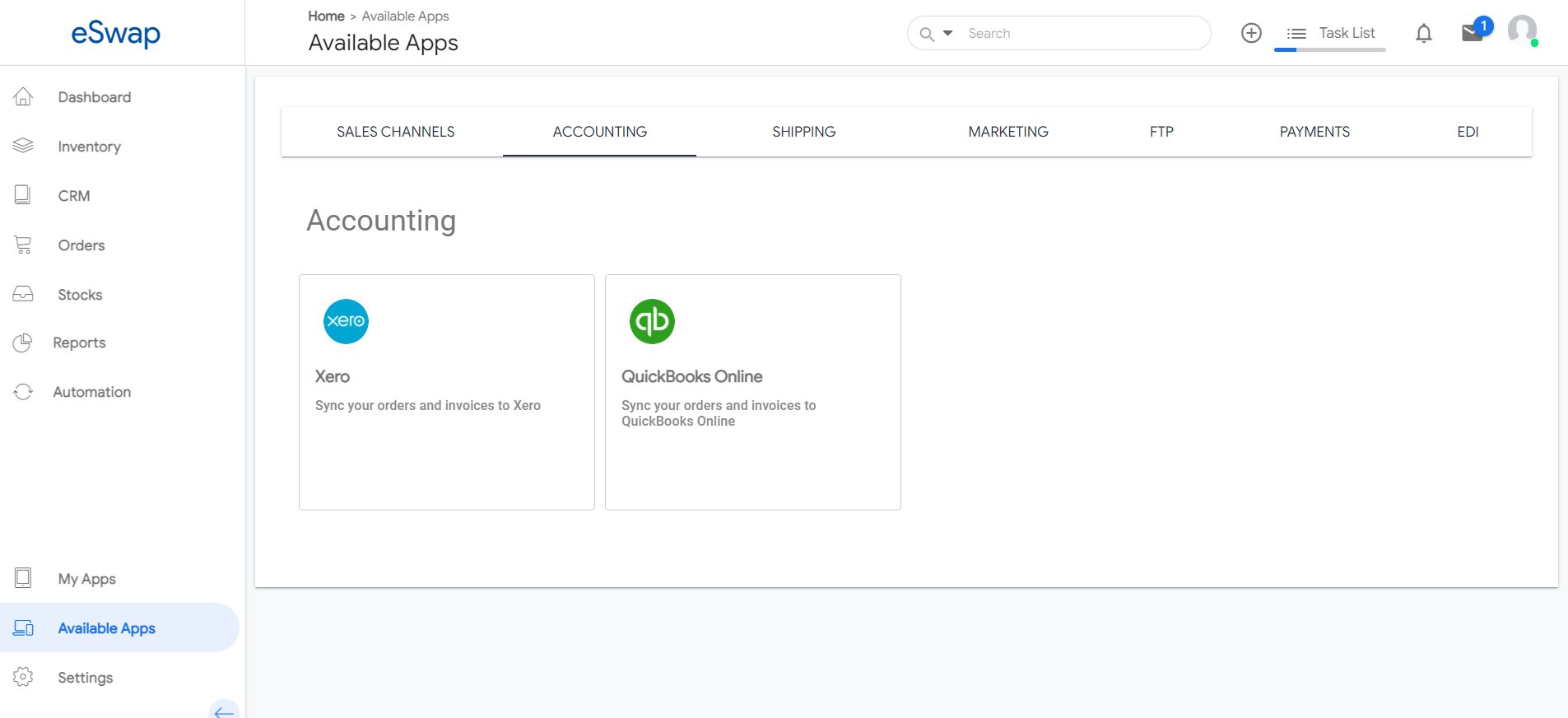

eSwap as an Inventory management tools offers its integrations with Quickbooks & Xero, which help to manage your accounting and calculations easily without spending time and resources on the tiring procedure of calculating and keeping your stock up-to-date.