Products come in all shapes and sizes: from the ones we wear to those we drive to the food we eat. And each one of these products has a journey beginning with raw materials and ending with the consumer using or disposing of the product. But here’s a dilemma! Why do some products “turnover” quickly while others languish on store shelves or in our homes? The inventory turnover ratio (a.k.a. “inventory turns”) is a crucial metric helping us understand how quickly products are moving through the supply chain—from raw materials to finished goods.

First things first! Let’s define the main terms and see how the inventory turnover ratio formula is derived.

Key Terminology

Inventory

Inventory refers to all the raw materials, work-in-progress, and finished goods that a company has on hand at any given time. While “on hand” usually means physically present at the company’s facilities, it can also refer to inventory that’s en route but not yet received.

Raw Materials

Raw materials are the unprocessed inputs used in manufacturing (e.g., steel, plastics, fabrics).

Inventory Turnover

Inventory turnover, or inventory turns, refers to the number of times a company’s inventory is sold or used up over a while. It takes the cost of goods sold relative to the average inventory of some period. The ratio’s role is to assess a company’s performance from the point of generated sales.

Understanding inventory turnover is a crucial step toward solid business performance. It would not be an exaggeration to state that the stock movement through the supply chain is the essence of the business for many companies. Inventory movement operations are one of the primary measures of future business success. The inventory turnover ratio is one of the gauges of that movement. It shows how well a company manages inventory that comes from suppliers and moves through the supply chain.

Reasons Why Inventory Turnover Ratio Matters

There are several reasons why the inventory turnover formula is so important:

1) It’s a leading indicator of future sales. If a company has a high inventory turnover, i.e., products are selling quickly, which is usually a good sign for future sales. On the other hand, if inventory turnover is low, it may indicate that future sales will slow down.

2) The inventory turnover ratio improves different business decisions, including those referring to pricing, production, procurement, and marketing activities. To assess the competitiveness of the business, the calculation can be compared to the ones of previous periods, estimated and planned ratios, and industry averages.

3) It’s a good measure of a company’s operational efficiency. The higher the inventory turnover, the less working capital is tied up in inventory, and vice versa.

4) It affects a company’s financial statements. The inventory turnover calculation is used in the denominator of the working capital ratio. As a result, higher inventory turns will result in a lower working capital ratio.

Deriving the Inventory Turnover Ratio Formula

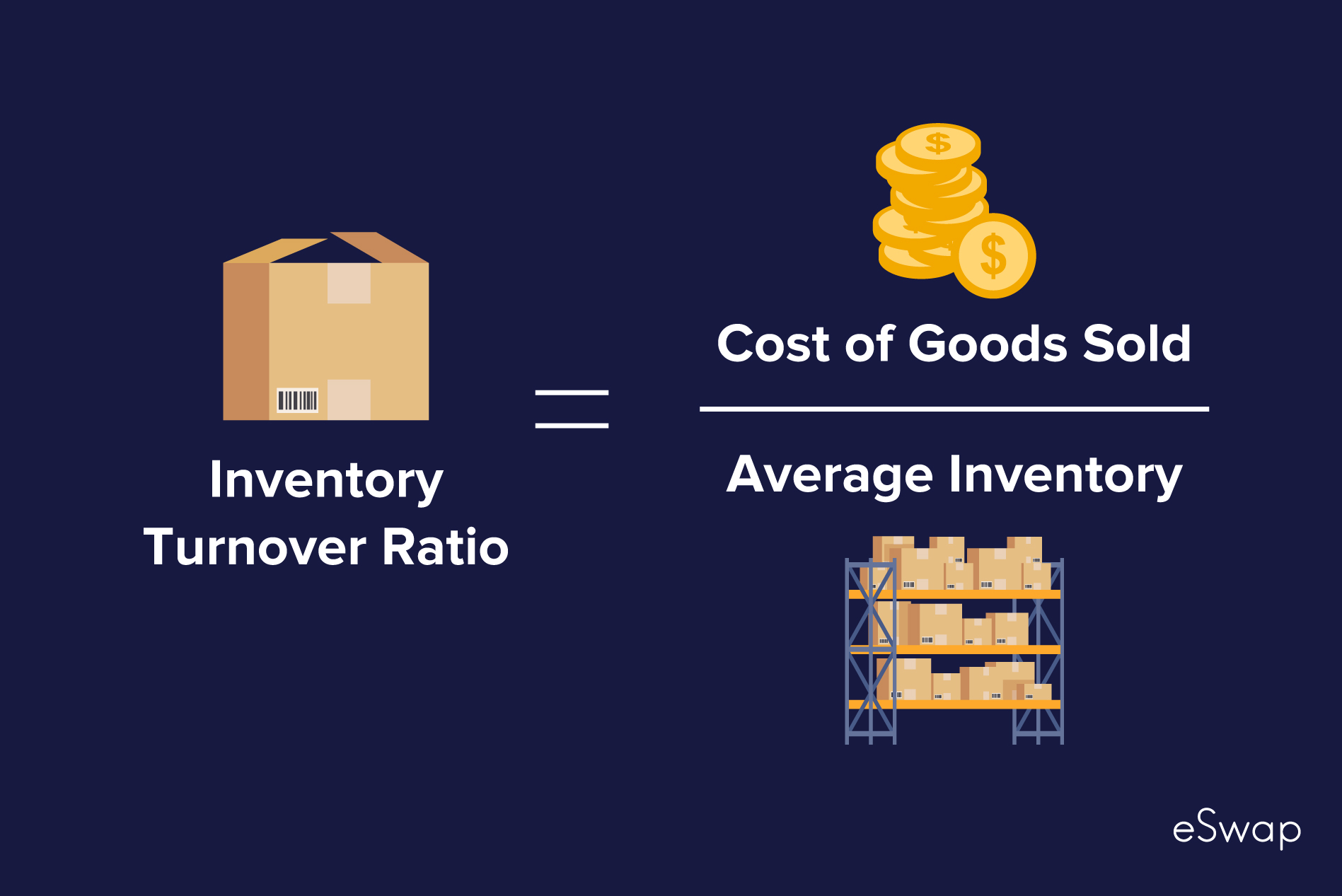

So, it’s clear that the financial ratio shows the amount of inventory sold over a specific period. The formula for data calculations is relatively simple:

Where: COGS equals the direct and indirect costs that occur while producing and selling goods. It can include the cost of materials, labor, factory overheads, shipment, etc.

Average inventory is the inventory at the beginning of the period plus inventory at the end of the period divided by two.

The ratio uses average inventory to calculate the inventory turnover because companies might have high fluctuations at certain times of the period. By averaging the amount, the business will get a more accurate ratio.

Case Study

Company M is operating in the automotive industry. According to the income statement of the last financial year, M reported costs of goods sold of $1,000,000. As you can see in the balance sheet, the opening inventory was $2,000,000, and the ending inventory was $3,000,000.

So, putting these data in a formula, we get the following:

Inventory Turnover Ratio = $1,000,000/($2,000,000+$3,000,000)/2 = 0.4

The turnover rate is 0.4, which means that M sold almost half of its inventory during the financial period. It also means that it would take M more than two years to sell the whole stock or complete one turn. Whether this is a good image or not depends on the industry characteristics.

What if the Ratio Is Low?

The inventory turnover ratio estimates the speed at which the company sells its inventory. A low ratio indicates that the sales are weak or the inventory levels are probably higher than required, known as overstocking. The reasons for the low inventory turnover ratio can be very different. It can be the quality or choice of goods resulting from ineffective marketing or its absence.

In any case, a low inventory turnover is a serious sign that a business owner should not ignore. The company might have cash flow problems in the future because it’s not generating enough revenue to cover inventory costs.

What if the Ratio Is High?

The best scenario is when good sales volumes cause a high inventory ratio. If the inventory turnover ratio is high, it can either indicate strong sales practices or a low inventory level, also called understocking. On the other hand, if the ratio is high because of understocking, the business might lose potential sales.

Issues like understocking and overstocking are not easy to solve. The company might need to analyze customer behavior or review its marketing strategy carefully.

To handle this, companies can invest in inventory management software to upscale their business processes and make data-driven decisions. The software will provide businesses with the necessary tools to streamline their inventory, optimize stock levels, and reduce operational costs.

The rate at which a business sells its stock is a crucial measure of its performance. The longer inventory is held, the higher its handling costs and the risks associated with the deadstock. Thus, companies moving out of the stock faster tend to outperform competitors.

How to Improve the Inventory Turnover Ratio?

There are a few ways in which companies can work to improve their inventory turnover ratio. The most common ones are:

- Review the business’s marketing strategy. Increase the customer demand for the goods through correctly targeted, cost-effective, and well-developed marketing campaigns and promotions.

- Implement an inventory management system. Ensure that all inventory items are recorded, and the system runs smoothly. The goal is to optimize stock levels and prevent issues like overstocking or understocking.

- Analyze customer behavior. People’s needs and preferences change over time, so the company should always be aware of them.

- Evaluate and update the reordering process regularly. Company owners or inventory managers should clearly understand how much inventory they need and when they should restock it. Also, don’t forget to examine and update the pricing strategies regularly. The same goes for analyzing what will generate higher sales volumes.

- Reviewing current customer demand and adapting the marketing strategy to it is the primary way of ensuring that the company sells more and, consequently, has a higher inventory turnover ratio.

- Identify and eliminate slow inventory by conducting unique methods like ABC analysis. It will help you optimize the warehouses and stock levels by highlighting the products that generate the most revenue and, therefore, should be given more attention.

Key Takeaways

Today’s research showed that the inventory turnover ratio is a key metric to track, no matter how big or small your company is. The ITR measures the number of times a company’s inventory is sold or used up in a given period and is used to assess whether a company has too much or too little inventory on hand.

Since a generally higher turnover ratio indicates more sales from a particular inventory volume, it is preferable. So, it indicates high liquidity and financial strength. Another benefit of a high ratio is that it reduces the risk of inventory theft, damage, or obsolescence.

However, there can be cases when a high ratio means lost sales because of understocking. Like other financial performance ratios, companies should compare this inventory turnover ratio to industry benchmarks to assess whether the business performs well or poorly.

Aligned to the ratio changes, companies can adopt necessary measures to improve it. The most common ones are: reviewing the business’s marketing strategy, implementing an inventory management system, analyzing customer behavior, etc.

The Bottom Line

In conclusion, any company for which inventory is one of the primary assets must be aware of its inventory turnover ratio and take action to improve or maintain it at the desired rate. It provides essential insights into how well the company sells its products and can indicate potential issues owners need to address.